The Target Market Determination (TMD), where applicable, for the product is available on our website at /policy-documents.

You should consider if the advice is right for you and read the PDS available at /policy-documents before making a decision to buy or continue to hold a product.

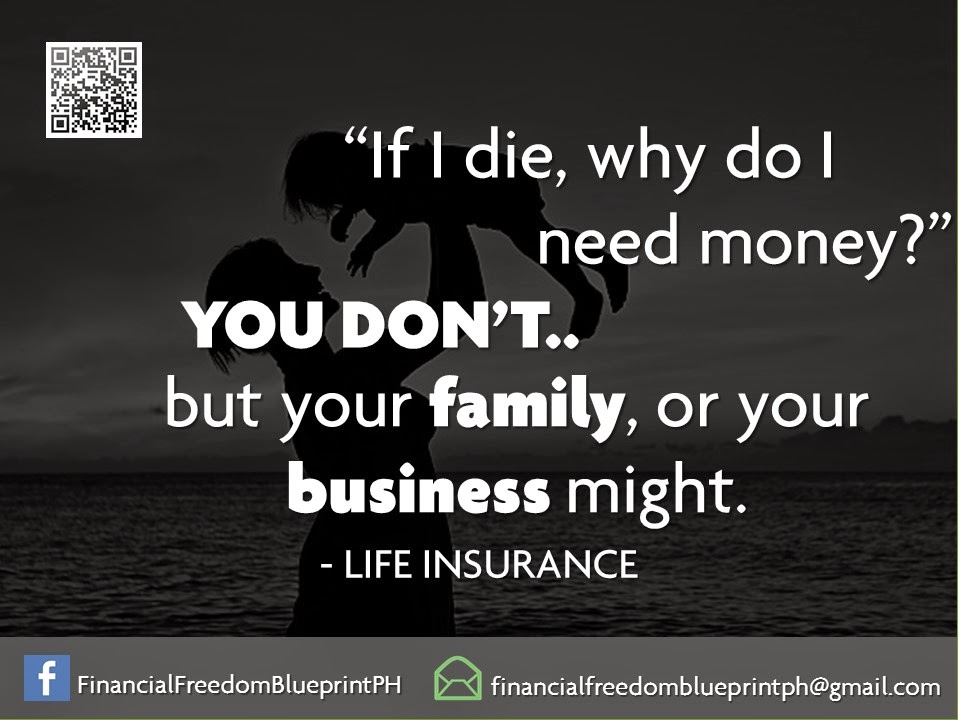

Just like us all, life insurance isn’t a one size fits all situation, so you might want to look for a policy that can help cover your family through life’s changes. Naming a beneficiary means your benefit will be paid directly to the person you nominate, rather than going into your estate. When you take out a life insurance policy, you can choose who the lump sum will be paid to. The lump sum can help cover expenses such as rent or mortgage, groceries, education, medical and other long term costs. This can help ease the financial burden on your loved ones at a time that can be emotionally, mentally and financially stressful. Life insurance provides a lump sum benefit to your loved ones if you pass away or are diagnosed with a terminal illness. Looking after our loved ones is important, which is why it’s a good idea to consider life insurance.

0 kommentar(er)

0 kommentar(er)